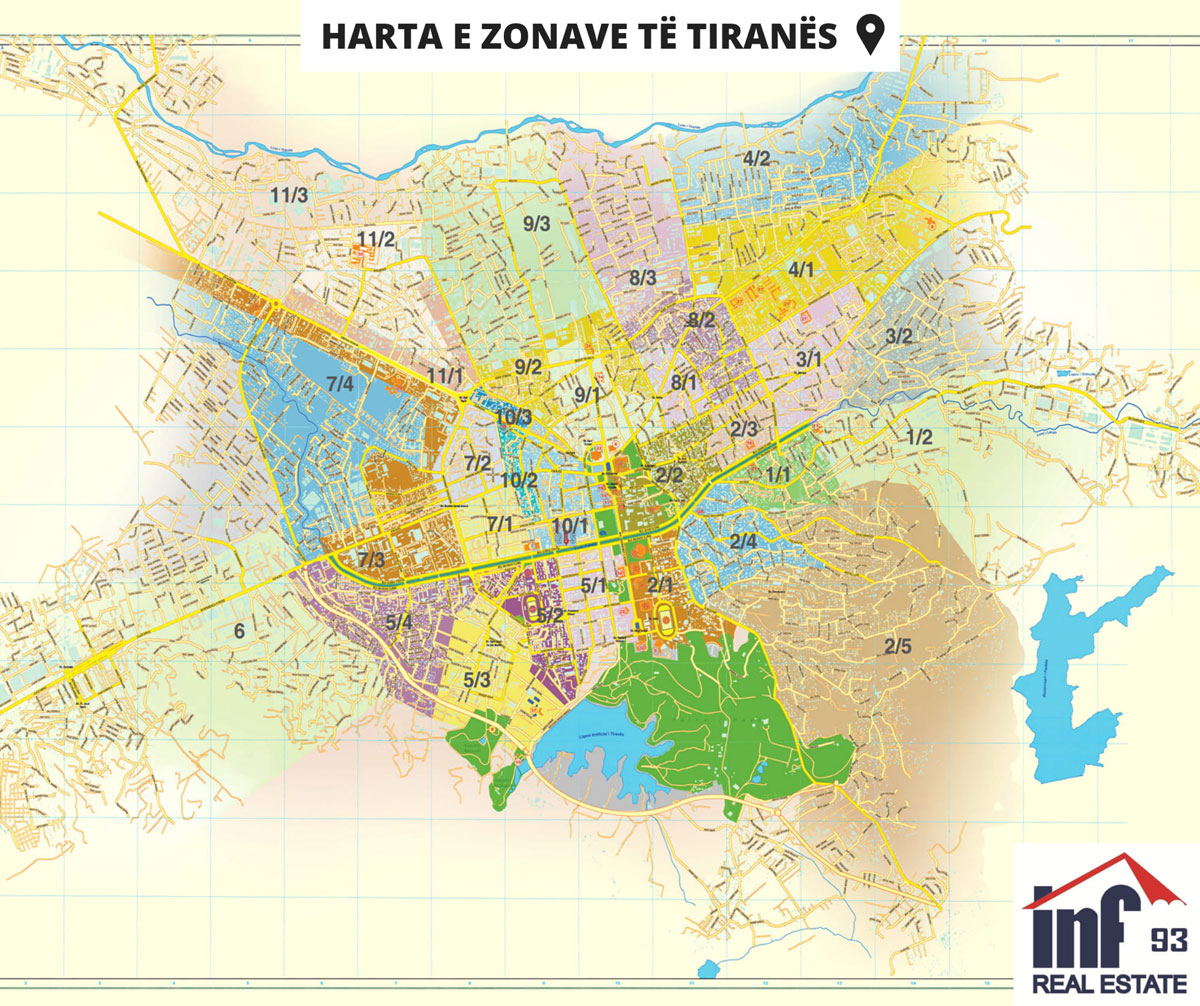

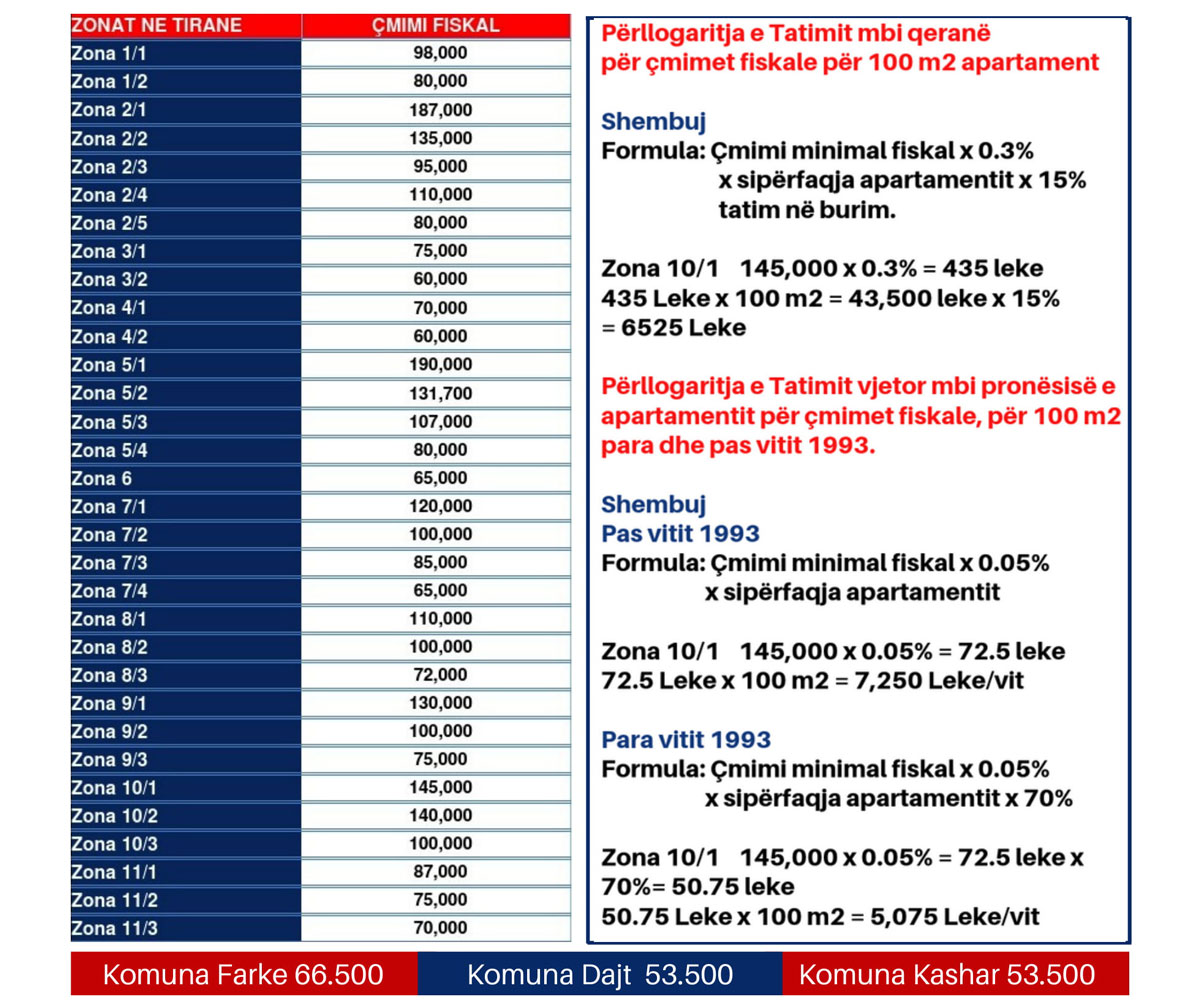

TIRANA FISCAL PRICES

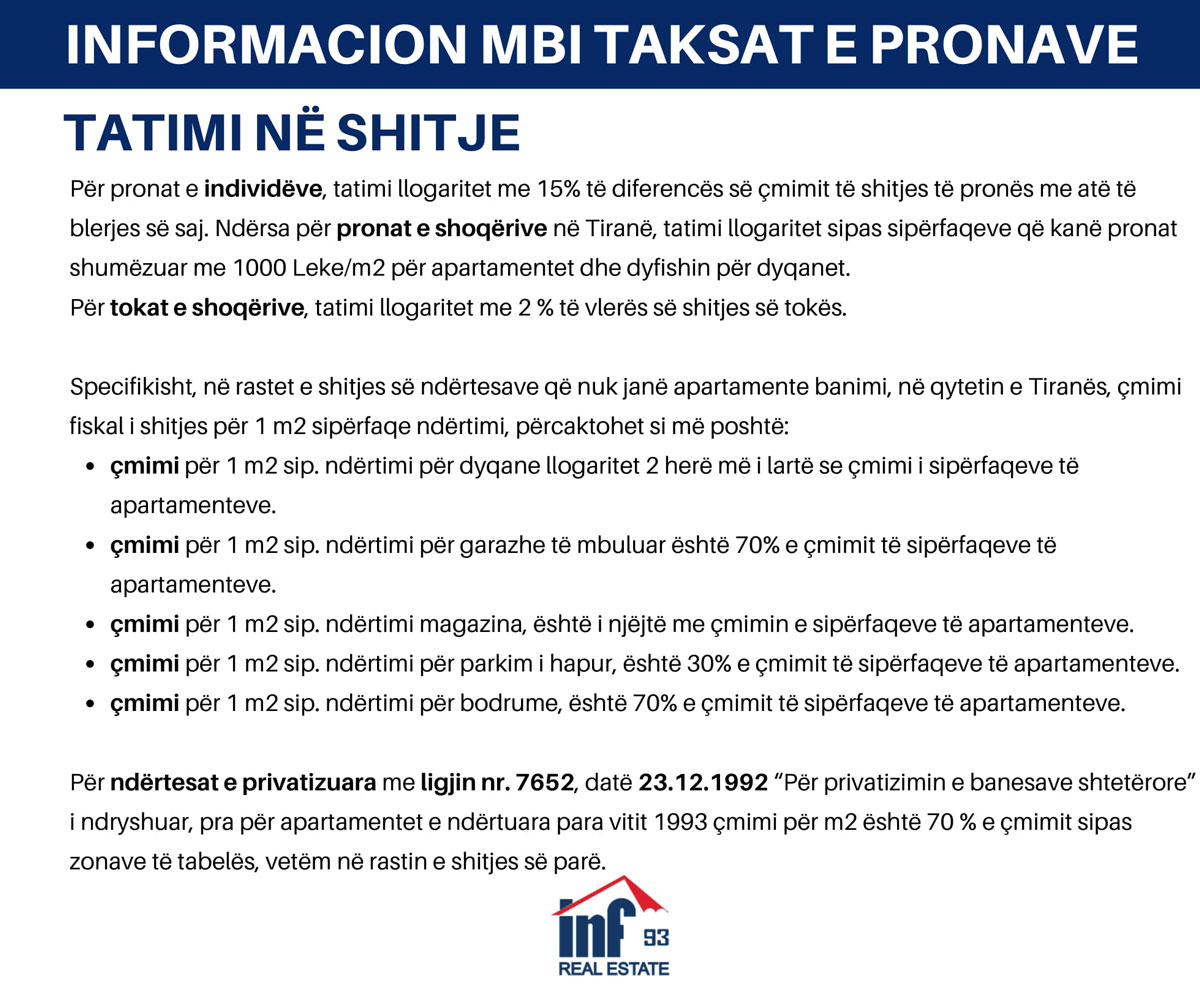

- For individual properties, the tax is calculated at 15% of the difference between the selling price and the purchase price of the property.

- For company-owned properties in Tirana, the tax is calculated based on the surface area of the property, multiplied by 1,000 ALL/m² for apartments and double for shops.

- For company-owned land, the tax is calculated at 2% of the sale value of the land.

- Specifically, in the case of selling buildings that are not residential apartments in the city of Tirana, the fiscal selling price per 1 m² of construction area is determined as follows:

- The price per 1 m² of construction area for shops is calculated to be twice as high as the price of apartment areas.

- The price per 1 m² of construction area for covered garages is 70% of the price of apartment areas.

-

The price per 1 m² of construction area for warehouses is 50% of the price of apartment areas.

-

The price per 1 m² of construction area for offices is 200% of the price of apartment areas.

- The price per 1 m² of construction area for open parking spaces is 30% of the price of apartment areas.

- The price per 1 m² of construction area for basements is 70% of the price of apartment areas.

- For buildings privatized under Law No. 7652, dated 23.12.1992, "On the Privatization of State-Owned Housing," as amended, meaning apartments built before 1993, the price per m² is 70% of the price according to the zone table, only for the first sale.